Mileage refund calculator

We earlier published 2010 mileage reimbursement calculator that can be used to compute the gas reimbursement for 2019 as well. And is based on the tax brackets of 2021 and 2022.

Mileage Reimbursement Calculator

Features IRS standard mileage rates.

. Simply head to our calculator to see if you are eligible and get started with your claim. An ordinary expense is a common cost or. Flexibility in Figuring Out Whats Deductible.

You can take a medical tax expense deduction only if your overall unreimbursed medical costs exceed 75 of your adjusted gross income AGI. Estimate Your 2022 Tax Refund For 2021 Returns. In fact its average effective property tax rate of 057 is lower than all but seven states and Washington DC.

Rules will be updated irregularly please check TPM TICKETED POINT MILEAGE for actual mileage published by IATA. How to claim Mileage Allowance Relief. UK mileage rates can differ however HMRC advisory fuel rates state that in most circumstances you can claim business mileage at a rate of 45p per mile for the first 10000 business miles in a year and then 25p per mile thereafter.

Use for gas calculator gas mileage IFTA tax truck gas mileage miles calculator mileage rate calculator google mileage calculator and IFTA fuel tax. Based on the data entered and the tax refund amount shown at WPRO-10 above we suggest you reduce your tax withholding to. Notice 2021-02 PDF should be referredIt contains the optional 2021 standard mileage rates as well as the maximum automobile cost used to calculate the allowance under a fixed and.

The only gas mileage calculator that calculates gas mileage and toll costs across states in United States and provinces in Canada for trucks from 2-axles to 9-axles. Just tell us a bit about the work and mileage youre doing and whether youre self-employed or working PAYE. You can plan ahead and make sure that you spend your refund wisely when it arrives.

Refer to the tables to see the minimum amount of Points required for a given fare class. From 5 October 2022 require cancellation and refund if applicable of the original ticket. The 150 Air Miles App was built specifically for truck drivers and passenger drivers who meet the criteria of T itle 49 Code of Federal Regulations 3 951 and the Canadian Commercial Motor Vehicle Drivers Hours of Service Regulation Section 812 and do.

Security The Tax Withholding Estimator doesnt ask for personal information such as your name social security number address or bank account numbers. Just send an email to email protected with your order number in the subject line explaining that you would like a refund. WASHINGTON The Internal Revenue Service today issued the 2020 optional standard mileage rates PDF used to calculate the deductible costs of operating an automobile for business charitable medical or moving purposes.

Enter your origindestination and tier status to know your applicable accrualredemption. Find out the mileage you will earnredeem. The IRS says that taxpayers should expect to receive their refunds within 21 days after filing their tax returns.

It only takes a few moments to use the rebate calculator. 3 No refund fee will be charged for mileage tickets that are refunded on the same day at midnight Korea Standard Time 7 days prior to departure and international mileage tickets that are refunded within 24 hours of purchase excluding seat promotion bonuses However online purchased tickets will be subject to booking criteria 7 days prior. We only need a few details from you in order for our accountants to review your claim and process the rebate with HMRC.

The QuickBooks Online Payroll subscription will terminate immediately upon cancellationYou will not receive a pro-rated refund. It can let you adjust your tax withheld up front so you receive a bigger paycheck and smaller refund at tax time. Cut your driving mileage in half.

Your access and subscription benefits will continue for the remainder of the billing period. Where can I find the official IRS mileage rates. IR-2019-215 December 31 2019.

Use any of these 10 easy to use Tax Preparation Calculator Tools. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Beginning on January 1 2020 the standard mileage rates for the use of a car also vans pickups or panel.

Invest your annual tax refund. The mileage tax deduction rules generally allow you to claim 056 per mile in 2021 if you are self-employed. Overview of West Virginia Taxes.

Contractors subcontractors and construction workers work full time seasonally or often have side jobsTo ensure you pay the correct amount of taxes keep track of your ordinary and necessary expenses for each of your jobs should the IRS ask for documentation. IR-2019-110 June 12 2019. You may also be able to claim a tax deduction for mileage in a few other specific circumstances including if youre an armed forces reservist qualified performance artist or traveling for charity work or medical reasons.

This 2021 Tax Return and Refund Estimator provides you with detailed Tax Results during 2022. It is mainly intended for residents of the US. Investment Calculator is a beautifully simple calculator to help you calculate the potential value of your retirement investments and visualize their growth.

Mileage Calculator is only applicable for BRB7 operated international flight including Purchased Fare Class and Tier Bonus miles. You can claim over 45p tax-free as a business mileage allowance if you use your own car for a business journey. WASHINGTON Following the biggest set of tax law changes in more than 30 years the Internal Revenue Service continues to remind taxpayers to do a Paycheck Checkup to help make sure they are having the right amount of tax withheld.

Any new International Partner Airline Reward Seat ticketed from 5 October 2022 will be according to the new. Invalid booking classes for mileage accumulation are excluded. Need a mileage tracker or expense tracking app.

Mileage Tracking For Companies. You can deduct your mileage at the standard rate of 18 cents per mile for 2022 and 16 cents per mile for 2021 or you can deduct your actual costs of gas and oil. The cost of return shipping will born by the returnee.

Everlance automatically logs tax-deductible business mileage expenses receipts more. It doesnt matter whether youre travelling via public transport or your own vehicle. IRS standard mileage rates for calculating mileage deductions.

West Virginia has some of the lowest property tax rates in the country. Downsizing your driving by 50 could save you around 4000 per year. We provide the most streamlined service in the industry for claiming your Mileage Allowance Relief.

Ditch your car completely and save an average. The Tax Cuts and Jobs Act TCJA tax reform legislation enacted in December 2017 changed the way. Who Can Deduct Mileage for Medical Reasons.

Using the RIFT tax rebate calculator to work out your tax. Mileage reimbursement is an absolute must for companies with mobile employees. WPRO-12 In addition to your current IRS tax withholding which is most likely based on your latest W-4 and based on your entries we suggest you withhold this additional tax amount in order to balance or reduce the taxes owed with your 2022 Tax Return.

The 150 Air Miles App Version 2 Includes the Fuel and Mileage Log for IFTA Purposes and Pre-Trip and Post Trip Inspections. Estimating your refund does not have to be complicated thanks to the Free TurboTax refund calculator and the Free HR Block refund calculator. Examples of such out-of-pocket expenses can include the mileage of driving to interviews printing resumes or business cards.

Using the Mileage calculator to redeem Points.

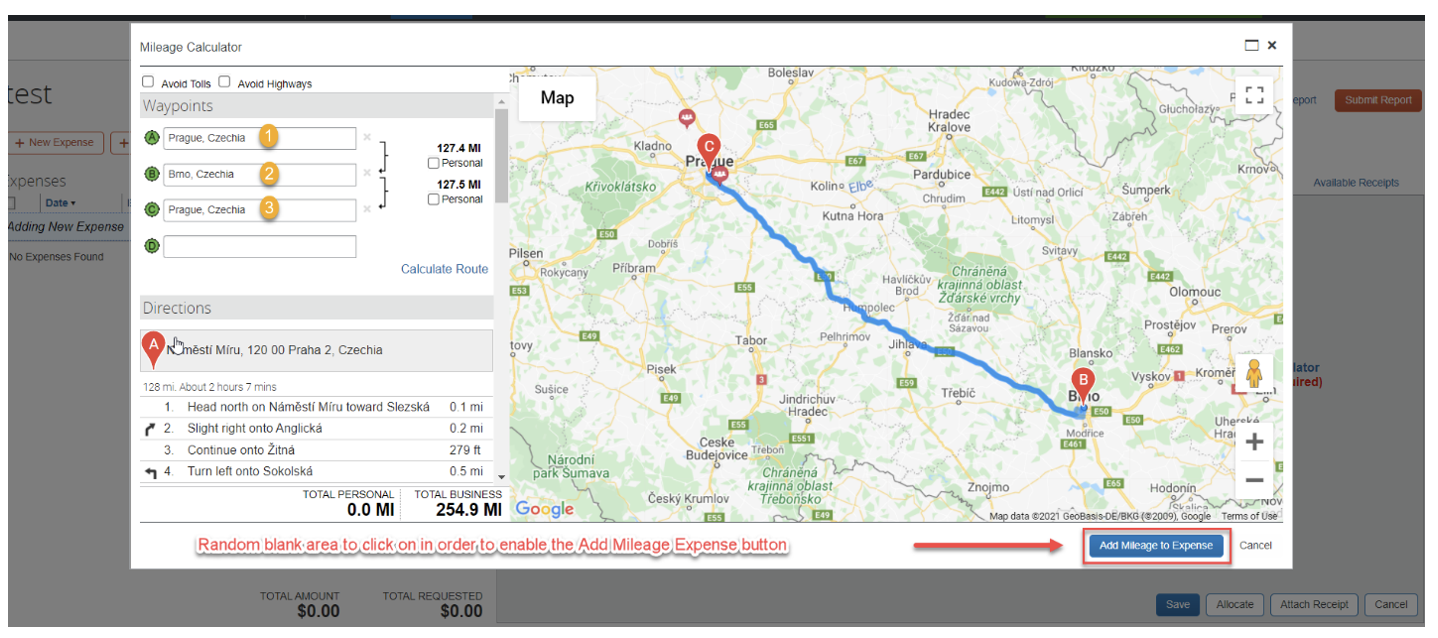

How Do I Submit Or Claim Mileage In Concur Expense Sap Concur Community

Mileage Reimbursement Calculator Mileage Calculator From Taxact

2022 Mileage Calculator Canada Calculate Your Reimbursement

How To Calculate Your Mileage For Reimbursement Triplog

How To Calculate Mileage Reimbursement Guide To Deductions

2022 Mileage Calculator Canada Calculate Your Reimbursement

Mileage Calculator Fuel Calculator Travel Cost Apps On Google Play

How To Calculate Mileage Reimbursement Guide To Deductions

How To Track Mileage On Google Maps With Fyle I T E I

Mileage Reimbursement Rates What You Need To Know Tax Alert June 2021 Deloitte New Zealand

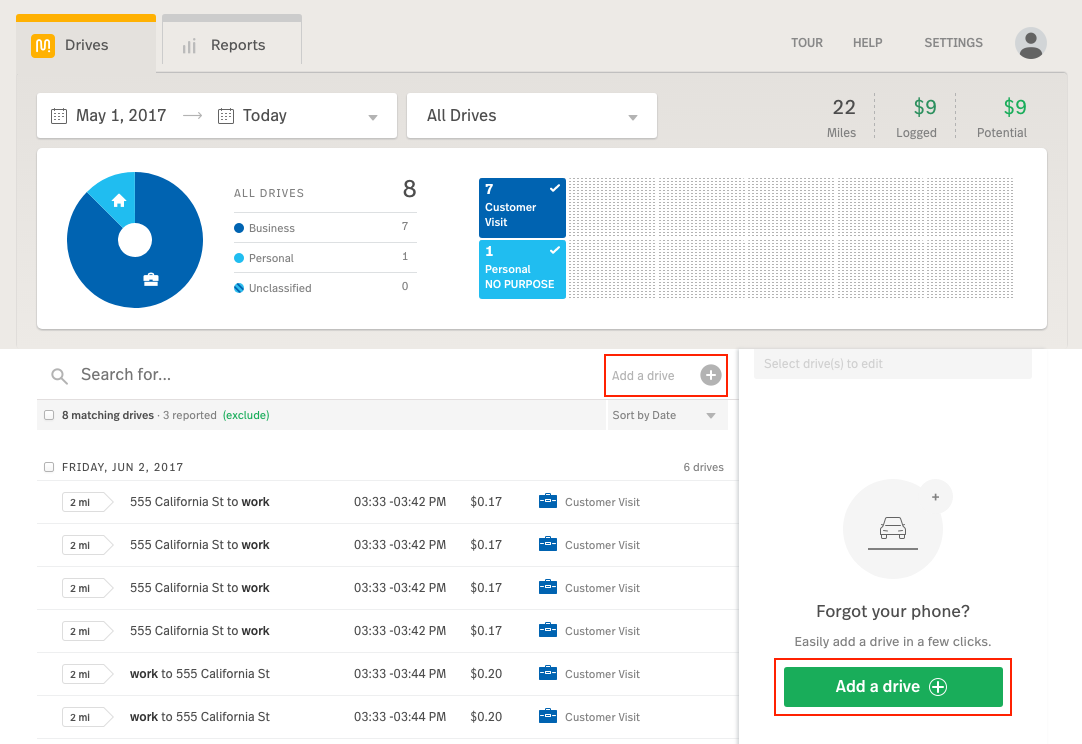

The 5 Best Mileage Tracker Apps In 2022 Bench Accounting

2021 Mileage Reimbursement Calculator

How To Calculate Your Mileage For Reimbursement Triplog

Vehicle24x7 Mileage Calculator Apps On Google Play

Mileage Log Template Free Excel And Pdf Template With Download

How To Calculate Mileage Reimbursement Guide To Deductions

How To Calculate Your Mileage For Taxes Or Reimbursement